5 Surprising Facts About FinCEN's New Real Estate Rule

The New Rule You Can't Afford to Ignore

As a real estate professional, you know that keeping up with new regulations is a constant part of the job. From local ordinances to federal mandates, the landscape is always shifting. However, a new federal rule is on the horizon that represents one of the most significant compliance changes in recent memory.

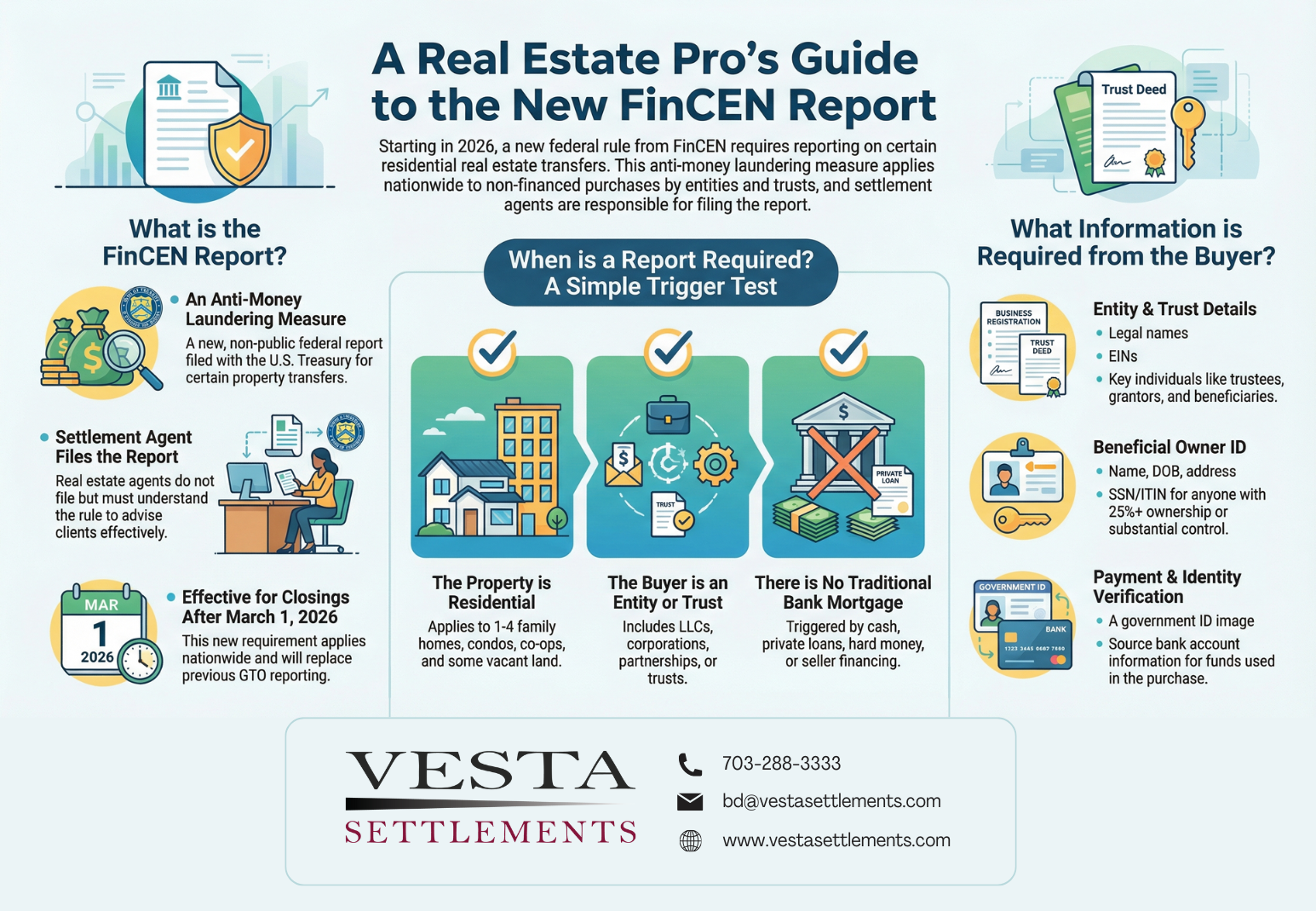

Effective March 1, 2026, the Financial Crimes Enforcement Network (FinCEN) is introducing a permanent, nationwide Residential Real Estate (RRE) Rule that will directly impact any transaction involving an entity, a trust, and non-traditional financing. As part of a broader federal effort to combat money laundering, this regulation fundamentally redefines client privacy and the very meaning of a "cash buyer." Here are the five most critical takeaways you need to understand to guide your clients and ensure smooth closings.

1. "Cash Buyer" Now Means Much More Than a Suitcase of Money

The first and most crucial thing to understand is that the rule's trigger isn't limited to transactions involving physical cash. FinCEN has dramatically expanded the definition of a "cash purchase." This new, broader definition now includes transactions financed through private loans, seller-financing, and hard money loans. It also covers deals involving a loan from any source that is not required to have a federal anti-money laundering program.

Just as important is the definition of "residential real estate" itself. The rule applies to a wide range of properties, including existing 1-4 family homes, co-ops, condominiums, and even vacant land where the buyer intends to build a 1-4 family residence.

This is a critical distinction because it means a much larger number of deals will fall under this reporting requirement than many agents might initially assume. A privately financed purchase by an LLC is no longer a simple transaction; it's now a reportable event.

2. This Isn't a Temporary Order—It's a Permanent, Nationwide Shift

Agents who are familiar with FinCEN's previous Geographic Targeting Orders (GTOs) must understand that the new RRE Rule is an entirely different category of regulation.

While GTOs were temporary measures limited to specific, high-risk metropolitan areas, the new RRE Rule is a permanent regulation that applies nationwide. It covers all residential real estate transfers in every U.S. state and territory that meet the trigger criteria. This represents a fundamental and lasting change in federal compliance for the entire residential real estate industry.

3. Anonymity is Over: The Veil on Entity and Trust Buyers Is Being Lifted

The long-standing practice of using an LLC or a trust to maintain a buyer's anonymity in a cash or privately financed deal is effectively over. The RRE Rule requires the disclosure of the "real people" behind these legal structures.

For any qualifying transaction, the settlement provider must collect and report detailed personal information on the individuals who ultimately own or control the buying entity or trust. This includes:

Legal name, date of birth, and home address

Taxpayer ID (such as a Social Security Number or ITIN)

A copy of a government-issued ID

For buyers, the method of payment (e.g., wire, check) and source of funds, including the specific bank name and account number

This reporting requirement applies to individuals with 25% or more ownership and anyone with "substantial control" (major decision-making authority). For trusts, the reporting applies to all trustees, as well as grantors who can revoke or withdraw assets and beneficiaries who can demand money or withdraw substantially all assets. The key takeaway for client conversations is clear:

“If privacy is a goal, do not promise anonymity. Tell clients to speak with their attorney.”

4. You Don't File the Report, But You're Key to a Smooth Closing

Here’s some good news: as a real estate agent, you are not responsible for filing the FinCEN report. That duty falls to the settlement or closing provider who prepares the settlement statement. In a split closing, the rule specifically designates the "reporting person" as the one who prepares the settlement statement for the buyer.

However, your role is absolutely crucial. You are on the front lines and must prepare your client for this new requirement to prevent closing friction and delays. The easiest way to spot a potential report is to use a simple "trigger test": Residential Property + Entity/Trust Buyer + No Traditional Bank Mortgage. If all three are true, a report is almost certain.

While the online form can be completed in as little as five minutes for simple ownership structures, client cooperation is essential. A fast response to the settlement provider's request for information is the key to an on-time closing, especially since the provider has a 30-day window after closing to file the report.

5. Even "No Cost" Gifts Can Trigger a Report

Perhaps one of the most counter-intuitive aspects of the RRE Rule is that it can apply even when no money changes hands. The reporting requirement can be triggered by no-cost transfers, such as a property being gifted to a family trust or LLC.

This detail highlights the regulation's broad scope. Its focus is on the transfer of residential property to an entity or trust without the involvement of traditional bank financing, regardless of whether a purchase price is paid. This underscores how important it is for agents to be aware of the nuances of the rule and avoid making assumptions about which transactions are covered.

Conclusion: A New Era of Transparency

The new FinCEN RRE Rule marks a significant and permanent shift toward transparency in the U.S. residential real estate market. The days of anonymous, all-cash entity purchases are coming to an end. For agents, this means a new responsibility: to be an informed, proactive guide who can confidently navigate clients through these new compliance requirements, ensuring they are prepared for what's ahead.